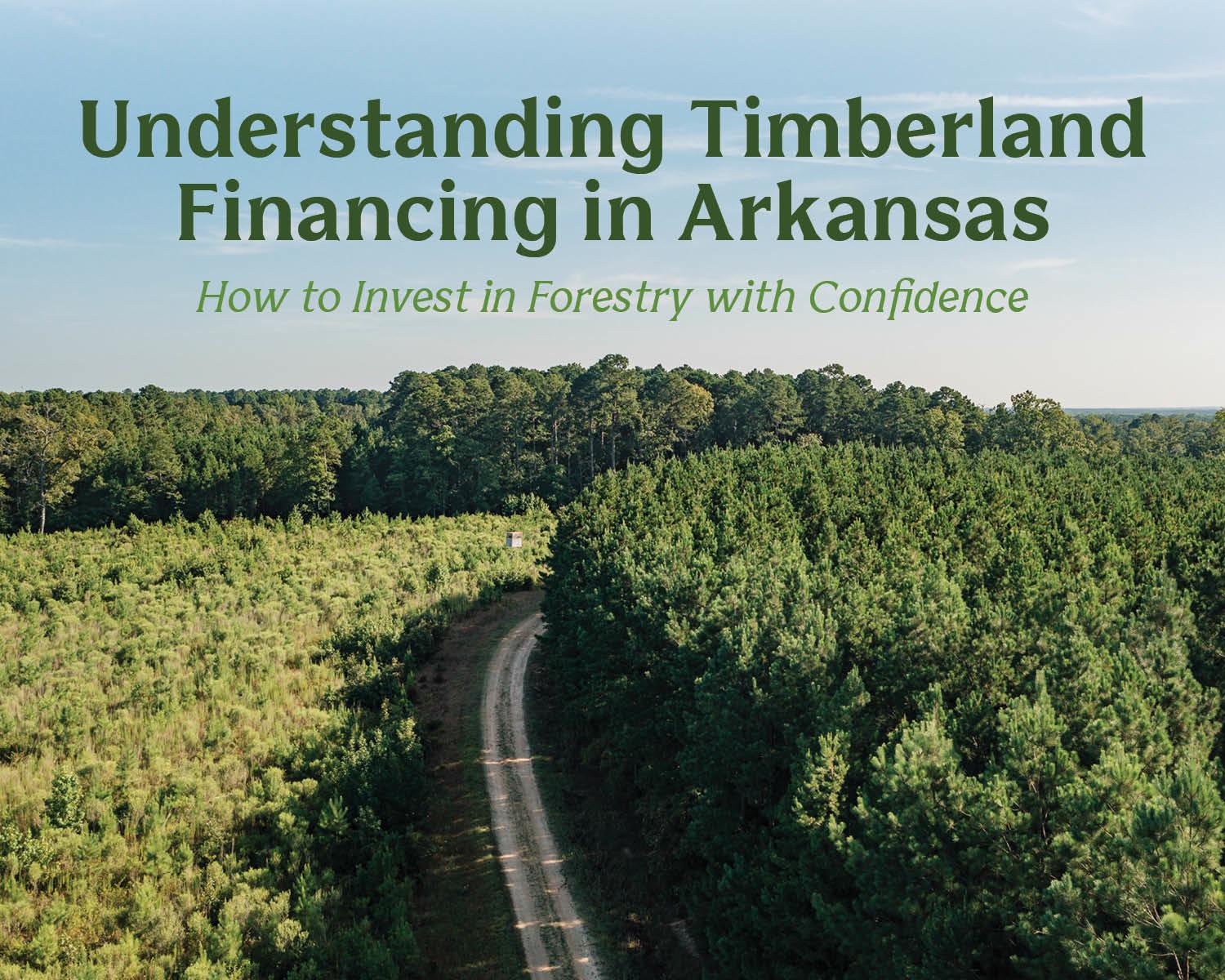

Understanding Timberland Financing in Arkansas

From long-term growth to smart investment strategies, learn how timberland financing works and why Arkansas remains a prime location for forestry investment.

Arkansas is one of the most timber-rich states in the country, with over half the state covered in forests and timber contributing more than 4% to Arkansas’ GDP.

At Farm Credit of Western Arkansas, we serve 41 counties across the region, giving us a front-row seat to how timber markets, forest management, and land investment all work together to drive the state’s rural economy.

Whether you’re a seasoned forest landowner or considering buying your first tract of timberland, understanding how timber cycles affect financing is key to making smart, long-term decisions.

How Timber Cycles Impact Timberland Loans

Unlike traditional farm or home loans, timberland loans are designed around growth cycles that often last 15 to 30 years. Because trees take time to mature and generate income, the loan structure typically looks a little different:

- Longer terms to match the growth and harvest cycle

- Interest-only payments during the early years before your first cut

- Balloon payments timed with expected timber sales

Lenders also monitor market fluctuations driven by housing starts and construction trends, which directly affect timber prices and harvest timing.

What Makes Timberland Financing Unique

Timberland loans require specialized expertise. Unlike typical real estate, the value of timberland comes from both the land and the standing timber — and both must be considered when determining value and risk.

Here’s what sets timber loans apart:

- Complex valuations: Farm Credit uses in-house foresters and certified appraisers who understand how to assess timber inventory, growth rates, and market value.

- Cash flow challenges: Timberland may not produce income for years, so flexible terms and repayment schedules are essential.

- Collateral risks: Fire, storms, pests, and market downturns can all impact value, which is why forestry consultants and harvest plans often play a role in the underwriting process

Why Investors Are Buying Timberland

Timberland is attracting attention from both institutional investors and private landowners seeking long-term, stable investments. The benefits include:

- Inflation protection: Trees continue to grow — and gain value — over time.

- Low correlation to stock markets: Timber returns often remain steady even when financial markets fluctuate.

- Tangible, renewable value: Investors benefit from both land appreciation and periodic timber harvests.

In Western Arkansas, abundant forest resources, affordable land, and a strong forestry infrastructure make the region especially appealing for investors looking to diversify their portfolio.

Understanding Timber as Collateral

Timberland provides a dual source of value — the underlying land and the standing timber.

Modern valuation tools, such as timber cruises, GIS mapping, and growth projections, enable lenders to estimate a property’s value accurately. However, it’s also important to factor in potential risks such as oversupply, fire, or disease.

Interestingly, Western Arkansas’s standing timber volume has nearly doubled over the past 30 years, contributing to today’s market oversupply and softer prices.

2025 Timber Market Outlook

The Arkansas timber market in 2025 presents a mix of challenges and opportunities:

- Oversupply: More trees are growing than are being harvested, putting downward pressure on prices.

- Soft markets: Pine pulpwood and certain hardwood products remain slow due to limited demand.

- Housing slowdown: Higher mortgage rates have reduced new home construction, impacting lumber demand.

Still, Western Arkansas remains one of the strongest timber investment regions in the South. Its vast forests, skilled labor force, and emerging opportunities in mass timber construction and bioenergy continue to create new possibilities for landowners and investors alike.

Financing Timberland with Farm Credit

At Farm Credit of Western Arkansas, we understand that timberland is more than just real estate — it’s a generational investment. Our team has decades of experience financing forest properties of all sizes and offers flexible options designed to fit the unique needs of landowners and investors.

If you’re looking to buy timberland, refinance, or explore your options for forest management, Farm Credit can help you grow with confidence.

Learn more about timber and forestry financing at myaglender.com or contact a lender today.

Other News